Derivatives can be complex and potentially high-risk financial instruments. The purpose of this post is to help you better understand their key features and how they correspond with counterparty risk so that you can make sound decisions in assessing risk and derivatives contracts.

The author of this blog, Jon Gregory, is the world’s top authority on ‘XVA’ (adjustments to the valuations of derivative contracts). We hope that by reading this post you will be able to take away valuable information that will assist you throughout your career.

This article will cover:

- Exchange-traded and OTC derivatives

- Counterparty risk – mitigation and credit exposure

- Counterparty risk – default probability and credit limits

Derivatives contracts represent agreements either to make payments or to buy or sell an underlying security at some future point.

Maturities may range from a few weeks or months – for example, futures contracts – to many years as is seen with long-dated swaps. The value of a derivative will change with the level of one or more underlying assets or indices and possibly decisions made by the parties to the contract. In many cases, the initial value of a traded derivative will be contractually configured to be zero for both parties at inception.

A key feature of many derivatives, such as interest rate swaps, is that their value can be both positive or negative depending on the evolution of market variables, e.g. interest rates. This makes the credit risk of derivatives bilateral and more complex than for traditional financial contracts such as loans. The bilateral nature also means that the credit risk of derivatives must typically be assessed on a portfolio basis. The credit risk of derivatives contracts is usually called counterparty risk.

Exchange-traded and OTC derivatives

Derivative exchanges are the lifeblood of an efficient and liquid market. Many of the simplest derivative products are traded on exchanges where traders can trade standardised contracts such as futures or options at a set price. Exchanges promote both efficiency and liquidity by centralising trade in one place.

Modern-day exchanges have a central clearing function that guarantees performance and therefore mitigates counterparty risk. Exchange-traded derivatives are usually assumed to be without any counterparty risk. However, this is due more to the simplicity of the products – they are typically short-dated and liquid – than the central clearing function.

Indeed, as recently as 2018, a default of one of the members caused substantial losses for the other members of a derivatives exchange. Compared to exchange-traded derivatives, OTC derivatives tend to be less standard, more liquid and long-dated and are traded bilaterally – with each side taking counterparty risk on behalf of the other party. It is a well-known fact that many end-user OTC derivative counterparties are unable or unwilling to post collateral, making material counterparty risk an unavoidable consequence.

A relatively small number of banks are fairly dominant in some OTC derivatives markets: these are generally large, highly interconnected and viewed as being ‘too big to fail’.

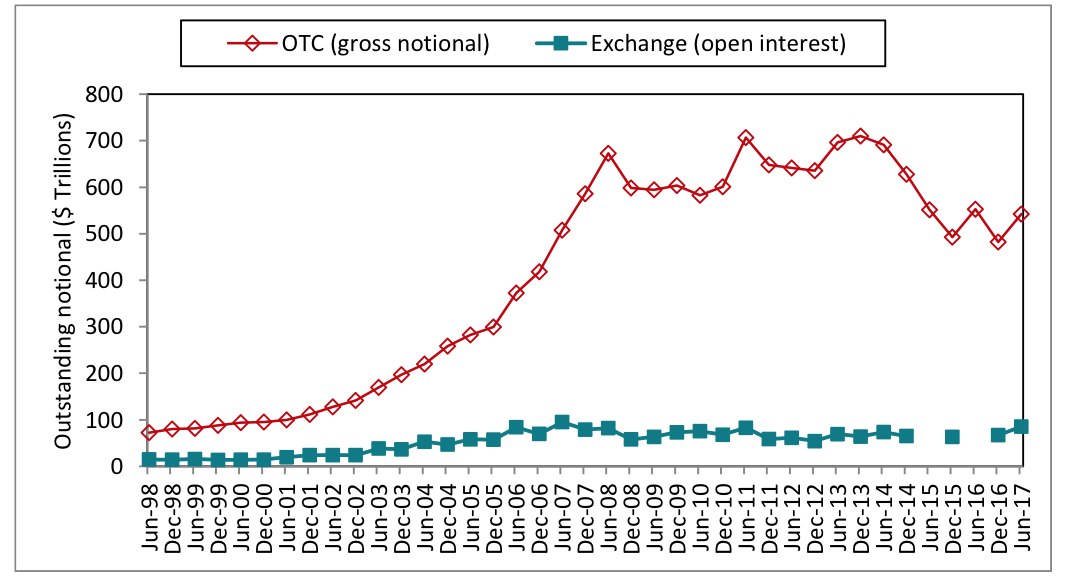

The OTC derivatives market has developed in the last two decades to be much larger than the exchange-traded market, with their relative popularity stemming from the ability of OTC products to tailor contracts to client needs (Figure 1). OTC products are used as customised hedging instruments and investment vehicles, and the OTC market has seen the development of brand new products such as credit default swaps.

Figure 1. Total outstanding notional of OTC and exchange-traded derivatives transactions. Note that this is only a guide to the amount of underlying risk. Source: BIS.

A significant amount of OTC derivatives are collateralised with parties posting and/or receiving cash and securities against the value of the portfolio to reduce the net exposure.

Collateral is a useful tool that can reduce counterparty risk. However, it also introduces additional legal and operational risks as well as liquidity issues because you need to source the cash or securities to deliver (this is why many end-users choose not to enter into these types of agreements with banks).

The trend to centrally clear OTC derivatives has been increasing since the late 1990s, in order to reduce counterparty risk. Centrally cleared derivatives retain some of their OTC features such as being transacted bilaterally, but use clearing functions that are developed for exchange-traded derivatives.

Central clearing does require an OTC derivative to have a certain level of standardisation and liquidity, and to not be too complex. This means that many types of OTC derivatives will never be suitable for central clearing. However, since the majority of the size of the derivatives market is dominated by just a few products such as interest rate swaps, the central clearing of these transactions has had a significant impact.

The types of derivatives available can be broken down into several main groups according to the way they are transacted and collateralised.

These groups, in increasing complexity and risk are:

- Exchange-traded. These are the simplest, liquid and short-dated derivatives that are traded on an exchange.

- OTC centrally cleared. These are OTC derivatives that are not suitable for exchange-trading due to being relatively complex, illiquid or non-standard but are centrally cleared.

- OTC collateralised. These are bilateral OTC derivatives that are not centrally cleared but where parties post collateral to one another to mitigate the counterparty risk.

- OTC uncollateralised. These are bilateral OTC derivatives where parties do not post collateral (or post less and/or lower quality collateral). This is typically because one of the parties involved in the contract (typically an end-user such as a corporate) cannot commit to collateral posting.

Lehman Brothers

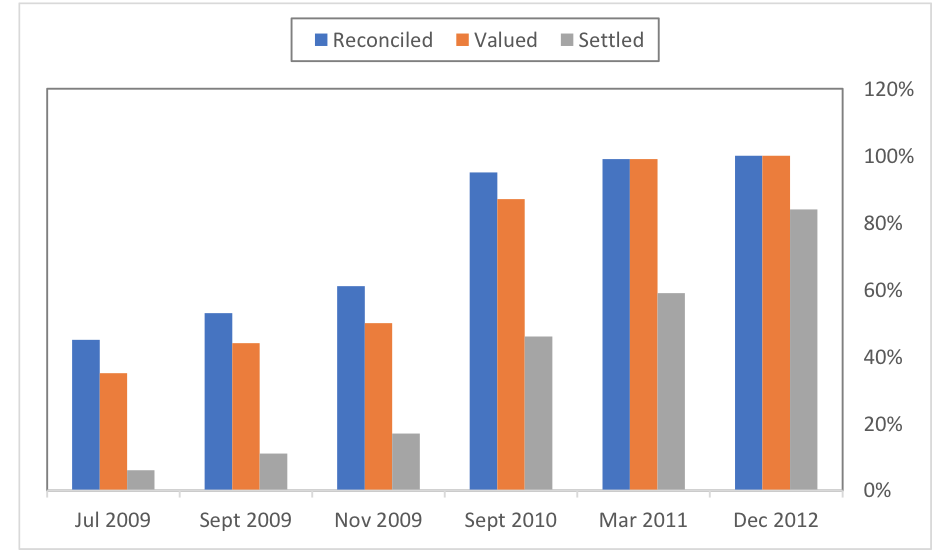

The Lehman Brothers bankruptcy in 2008 is an excellent example of the difficulties created by OTC derivatives. This company had 200 subsidiaries worldwide and around a million derivatives transactions. The insolvency laws of over 80 jurisdictions were relevant.

To fully settle with an OTC derivative counterparty, the following steps must be taken:

- reconciliation of the universe of transactions;

- valuation of each underlying transaction; and

- agreement of a net settlement amount.

As shown in Figure 2, carrying out the above steps across many different counterparties and transactions has been a time-consuming process.

Figure 2. Management of derivative transactions by the Lehman Brothers estate. Source: Fleming and Sarkar (2014).[1]

Counterparty Risk

Counterparty credit risk, often known just as counterparty risk, is the chance that your counterpart will fail to fulfil their side of the contractual agreement – e.g. they default. Typically, it arises from two broad classes of financial products: OTC derivatives such as interest rate swaps and securities financial transactions such as repos. The former category is more significant due to the size of the OTC derivatives market, the fact that transactions are generally long-dated, and due to many counterparties not posting collateral.

Two aspects differentiate contracts with counterparty risk from traditional credit risk:

- The value of the contract in the future is uncertain: the value of a derivative at a potential default date will be the net value of all future cash flows required under that contract. This future value can be positive or negative and is typically highly uncertain (as seen from today).

- Since the value of the contract can be positive or negative, counterparty risk is typically bilateral. In other words, in a derivatives transaction, each counterparty has a risk to the other.

Mitigation

There are several ways you can mitigate counterparty risk, some obvious examples include:

- Bilateral netting agreements allow cash flows to be offset and, in the event of default, for values of different transactions to be combined into a single net amount.

- Collateral – or margin – agreements specify the contractual posting of cash or securities against losses.

- Other contractual clauses. Other features such as resets or additional termination events aim to periodically reset values or terminate transactions early.

- Central counterparties. Central counterparties (CCPs) guarantee the performance of transactions cleared through them and aim to be financially secure through the collateral and other financial resources they require from their members.

- Hedging counterparty risk with products such as credit default swaps (CDSs) aims to protect against potential default events and adverse credit spread movements and variability from other factors such as interest rates and FX.

Credit exposure

If a counterparty defaults, credit exposure defines the loss. It also represents other costs such as capital and funding that appear in other xVA terms.

Exposure is characterised by the fact that a positive value of a portfolio corresponds to a claim on a defaulted counterparty. However, in the event of negative value, a party is still obliged to honour their contractual payments. This means that if a party is owed money and their counterparty defaults then they will incur a loss, whilst in the reverse situation they cannot gain[2] from the default.

Default probability

When assessing counterparty risk, it’s crucial to consider the credit quality of a counterparty throughout the entire lifetime of the relevant transactions. As such, time frames may be very long and the term structure of default is important to consider.

Default probability can be defined as real-world or risk-neutral: in the first case, we ask what the actual default probability of the counterparty is – this is often estimated via historical data. In the second case, we calculate the risk-neutral (or market-implied) probability from market credit spreads. Risk-neutral default probabilities have become virtually mandatory for CVA calculations in recent years; it’s required by market practice both in accounting guidelines and regulatory rules.

Loss given default

Recovery rates typically represent the percentage of the outstanding claim that is eventually recovered when a counterparty defaults. An alternative variable to recovery, however, is loss given default (LGD), which in percentage terms is 100% minus the recovery rate.

Default claims can vary significantly and LGD is therefore highly uncertain. In the event of a bankruptcy, the holders of OTC derivatives contracts with the counterparty in default would generally be pari passu[3] with the senior bondholders. OTC derivatives, bonds and CDSs generally reference senior unsecured credit risk and may appear to relate to the same LGD. However, there are timing issues: when a bond issuer defaults, LGD will be realised immediately since the bond can be easily sold on the market.

CDS contracts can also be settled within days of the defined ‘credit event’ via the CDS auction which likewise defines the LGD. However, unlike bonds, OTC derivatives cannot be freely traded or sold, especially when the derivative counterparty is in default. This essentially leads to a potentially different LGD for derivatives. These aspects were very important in the Lehman Brothers bankruptcy of 2008.

Credit limits

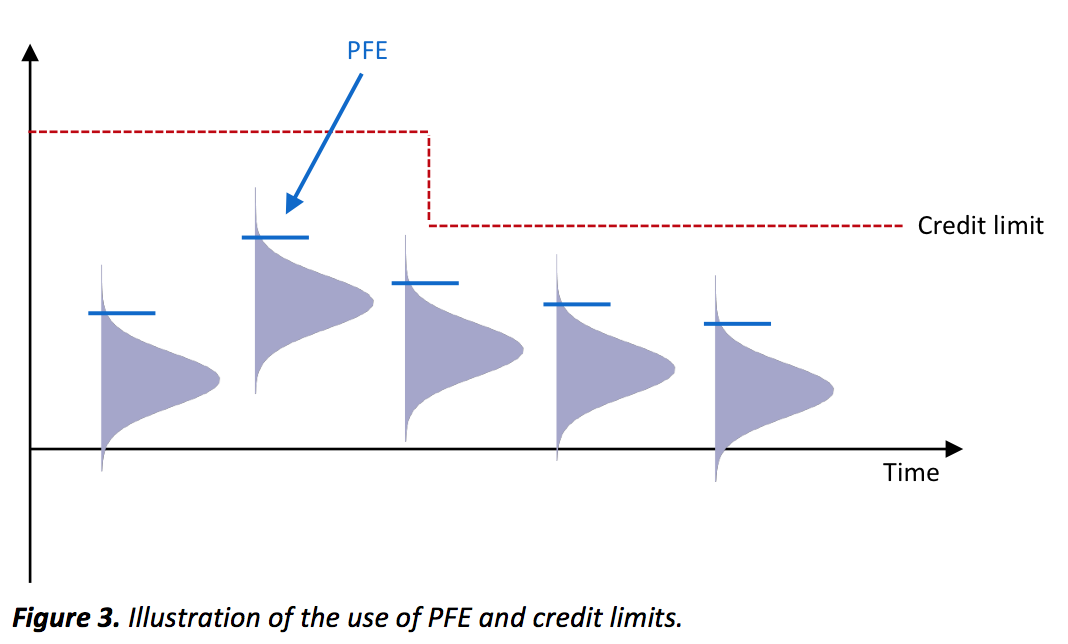

One way to reduce counterparty risk is by limiting your exposure to any given trading partner broadly in line with their perceived credit quality. However, this diversification is not always practical due to the relationship benefits from trading with certain key clients. Historically, the primary method of controlling counterparty risk was using limits to cap the amount of risk to a given counterparty over time.

Credit limits are generally specified at the counterparty level as illustrated in Figure 3. The idea is to characterise the potential future exposure (PFE) to a counterparty over time and ensure that this does not exceed a certain value (the credit limit). The PFE (a stress (high quantile) scenario and the credit limit will be subjectively set taking factors such as the credit quality of the counterparty into account. Broadly speaking, the following aspects must be accounted for when calculating the PFE (these also apply to CVA and other xVA terms):

- the transaction in question;

- the current relevant market variables (e.g. interest rates and volatilities);

- netting between the different transactions with the same counterparty;

- collateral terms with the counterparty (if any); and

- hedging aspects (e.g. buying single-name CDS protection).

[1] Fleming, M. J., and A. Sarkar, 2014, “The Failure Resolution of Lehman Brothers”, Federal Reserve Bank of New York Economic Policy Review, December, www.ny.frb.org

[2] Except in some special and non-standard cases.

[3] This means they have the same seniority and therefore should expect to receive the same recovery value.

Regulation and accounting

Two key aspects around xVA are regulation and accounting. The most obvious regulatory component is ruled on minimum capital standards, which are defined by the Basel Committee for Banking Supervision (BCBS). Accounting standards define the way in which derivatives’ value should be represented in financial statements, which has a significant impact on pricing and market practice.

In 2013, IFRS 13 accounting guidelines were introduced to provide a single guidance framework around fair value measurement for financial instruments.

IRFS 13 uses the concept of exit price which implies the use of risk-neutral (market-implied) information as much as possible. This is especially important in default probability estimation where market credit spreads tend to be used instead of historical default probabilities. Exit price also introduces the notion of own credit risk and leads to DVA.

Exit price is an important concept for xVA in general since any valuation adjustment that is generally seen in market prices should also apparently become an accounting adjustment. In recent years, this is exactly what has happened with FVA.

Establishing the minimum amount of capital that a given bank must hold is an important form of regulation. This benchmark must ensure there's enough capital to minimise any possibility of failure without being too severe or unfairly penalising the bank – which could have adverse consequences for their clients and the economy as a whole. Capital is important since banks generally aim for a minimum return on capital when pricing transactions.

So how can quantitative rules for regulatory capital be defined? This is difficult because a simple approach may be transparent and easy to implement, but it will not take into account all the complex risks that arise from a web of positions at a bank.

Basel III defines two capital charges in relation to counterparty risk which are:

- the CCR capital charge (sometimes known as the default risk capital charge); and

- the CVA capital charge.

There are different methodologies for computing these requirements. Banks with internal model method (IMM) approval can use their own models for this purpose. All other banks must follow simpler regulatory formulas which tend to be more conservative and are not as risk-sensitive.

New methodologies are also being introduced, in particular:

- SA-CCR (standardised approach for counterparty credit risk). This will be the CCR capital charge methodology for non-IMM banks which has been introduced from 2019 (and may represent a floor for IMM banks). At the current time, this has been adopted in some, but not all, countries/regions.

- FRTB-CVA (fundamental review of the trading book for CVA). This will represent new methodologies for the CVA capital charge from (according to the Basel rules) 2023.

There are other aspects that impact capital requirements such as the leverage ratio. On a related point, regulation over liquidity, such as the liquidity coverage ratio (LCR) is important for xVA.

If you’re interested in learning more about how to calculate counterparty risk, or if your company is seeking a specialist course that will give employees the skills they need to better understand derivatives, please contact us. We offer courses for individuals and companies alike with an emphasis on practical application of theory.

Related Courses

Bilateral Margining and Central ClearingValuation Adjustments: The XVA Challenge